Mastering Covariance: A Comprehensive Guide to Calculation and Applications

-

Quick Links:

- What is Covariance?

- Importance of Covariance

- Covariance Formula

- How to Calculate Covariance

- Step-by-Step Guide to Calculating Covariance

- Case Studies and Real-World Examples

- Common Mistakes When Calculating Covariance

- Covariance vs. Correlation

- FAQs

What is Covariance?

Covariance is a statistical measure that indicates the extent to which two random variables change in tandem. In other words, it assesses how changes in one variable are associated with changes in another variable. A positive covariance indicates that both variables tend to increase or decrease together, while a negative covariance implies that as one variable increases, the other tends to decrease.

Understanding Covariance in Everyday Terms

Imagine you are analyzing the relationship between the amount of time you study and your exam scores. If students who study more tend to score higher on exams, the covariance between study time and exam scores will be positive. Conversely, if students who study less tend to score higher—perhaps due to exam anxiety—the covariance will be negative.

Importance of Covariance

Covariance is crucial in various fields, including finance, economics, and data science. Understanding covariance helps in risk management, portfolio diversification, and predictive modeling. Here are some key reasons why covariance is important:

- Portfolio Management: Investors use covariance to determine the relationship between asset returns, aiding in the construction of diversified portfolios.

- Statistical Analysis: Covariance provides insights into the relationship between two variables, informing data-driven decisions.

- Predictive Modeling: It is used in regression analysis to understand how independent variables influence a dependent variable.

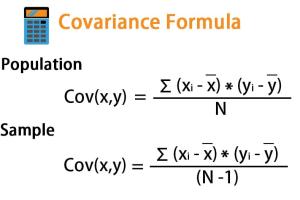

Covariance Formula

The formula for calculating covariance between two variables \(X\) and \(Y\) is given by:

Cov(X, Y) = Σ((X_i - μ_X) * (Y_i - μ_Y)) / n

Where:

- Cov(X, Y) = Covariance between X and Y

- Σ = Summation symbol

- X_i and Y_i = Individual sample points of variables X and Y

- μ_X and μ_Y = Mean of variables X and Y

- n = Number of data points

How to Calculate Covariance

Calculating covariance involves a series of steps. Let’s break it down:

- Gather your data for the two variables you want to analyze.

- Calculate the mean (average) for each variable.

- Subtract the mean from each data point to find the deviations.

- Multiply the deviations of the two variables together.

- Sum all of the products from step 4.

- Divide the total sum by the number of data points (or n-1 for sample covariance).

Step-by-Step Guide to Calculating Covariance

Example Scenario: Study Hours vs. Exam Scores

Let’s say we have the following data:

| Student | Study Hours (X) | Exam Score (Y) |

|---|---|---|

| 1 | 4 | 80 |

| 2 | 5 | 85 |

| 3 | 6 | 90 |

| 4 | 3 | 75 |

| 5 | 7 | 95 |

Step 1: Calculate the Means

The mean of X (Study Hours) is:

μ_X = (4 + 5 + 6 + 3 + 7) / 5 = 5

The mean of Y (Exam Scores) is:

μ_Y = (80 + 85 + 90 + 75 + 95) / 5 = 83

Step 2: Calculate Deviations

Now we find the deviations:

- (4 - 5) = -1

- (5 - 5) = 0

- (6 - 5) = 1

- (3 - 5) = -2

- (7 - 5) = 2

For Exam Scores:

- (80 - 83) = -3

- (85 - 83) = 2

- (90 - 83) = 7

- (75 - 83) = -8

- (95 - 83) = 12

Step 3: Multiply Deviations

Next, multiply the deviations of X and Y:

- -1 * -3 = 3

- 0 * 2 = 0

- 1 * 7 = 7

- -2 * -8 = 16

- 2 * 12 = 24

Total = 3 + 0 + 7 + 16 + 24 = 50

Step 4: Calculate Covariance

Finally, apply the covariance formula:

Cov(X, Y) = 50 / 5 = 10

Case Studies and Real-World Examples

To further illustrate the application of covariance, let's consider a couple of case studies.

Case Study 1: Financial Portfolio Analysis

In finance, investors often calculate the covariance of asset returns to build a balanced portfolio. For instance, consider two stocks, A and B. By calculating the covariance of their returns, investors can understand how these stocks move together. A positive covariance suggests that both stocks will likely move in the same direction, while a negative covariance would indicate an inverse relationship.

Case Study 2: Health and Lifestyle Choices

A health study might analyze the covariance between physical activity levels and body mass index (BMI). If researchers find a negative covariance, it would suggest that as physical activity increases, BMI tends to decrease, indicating a potential health benefit of increased exercise.

Common Mistakes When Calculating Covariance

While calculating covariance, it’s easy to make mistakes. Here are some common pitfalls to avoid:

- Not Using the Correct Formula: Ensure you differentiate between population covariance and sample covariance.

- Calculating with Incorrect Data: Always double-check your data entries.

- Misinterpreting the Result: Remember that covariance alone does not indicate the strength of a relationship; it simply shows the direction.

Covariance vs. Correlation

Understanding the difference between covariance and correlation is essential:

- Covariance: Measures the directional relationship between two variables but does not provide information on the strength of the relationship.

- Correlation: Normalizes covariance values to a range between -1 and 1, making it easier to interpret the strength and direction of the relationship.

FAQs

1. What does a positive covariance indicate?

A positive covariance indicates that two variables tend to increase or decrease together.

2. What does a negative covariance indicate?

A negative covariance suggests that as one variable increases, the other tends to decrease.

3. How is covariance different from correlation?

Covariance indicates the direction of the relationship, while correlation provides both the strength and direction of the relationship.

4. Can covariance be negative?

Yes, a negative covariance indicates an inverse relationship between the two variables.

5. What is the covariance of independent variables?

The covariance of independent variables is zero, indicating no relationship between them.

6. How do I interpret covariance values?

Covariance values can be interpreted qualitatively: positive values indicate a direct relationship, while negative values indicate an inverse relationship.

7. Is covariance sensitive to outliers?

Yes, outliers can significantly affect the covariance calculation.

8. How do I calculate sample covariance?

Use the same formula but divide by (n-1) instead of n, where n is the sample size.

9. What software can help calculate covariance?

Statistical software like R, Python (NumPy library), and Excel can be used to calculate covariance.

10. What are the applications of covariance in real life?

Covariance is used in finance for portfolio analysis, in statistics for relationship studies, and in various fields for predictive modeling.

Random Reads

- How to turn off icloud completely or disable icloud sync

- How to mute yourself during a zoom call

- How to clean brushed stainless steel

- How to log in to telegram web

- How to adjust hot water heater

- How to clear a clogged drain with standing water

- How to archive folders windows mac

- How to arch a doorway

- How to measure stairs for carpet

- How to merge layers in photoshop